We have a tendency to carry all kinds of personal items in our purse or wallet. While it is necessary to carry some things such as your driver’s license or credit card it can be dangerous to carry other documents and information.

There are things you might need to carry with you for a certain activity or appointment but they can be left at home when you are not using them.

Personal items you carry with you can lead to identity theft if they are lost or stolen.

Install a password manager on your smartphone. A password manager is a secure, encrypted database that you use to save your usernames and passwords, notes, lists and other information you need to remember so that you don’t have to carry a hard copy of those documents with you.

KeePass is a free password manager for smartphones, tablets and computers. KeePass Password Safe

You can also store digital copies of your important documents on your smartphone. You can do this by taking a picture of the document or by saving a scanned copy. Then you can easily access those documents from anywhere. Just be sure to password protect your smartphone and store the digital copies in a secure location.

Don’t Carry

Social Security Card

Never carry your Social Security Card, instead memorize your Social Security number or store it in your password manager. Very few establishments ask for your Social Security number or need a copy of your card. If they do ask you should question them as to why they need it and how they can guarantee it will not be compromised. They can offer no such guarantee. Explain that you do not provide your Social Security number for security reasons. Data breaches are an everyday occurrence and if a business has your Social Security number on record and they are compromised all of the information they have can be stolen.

Birth Certificate

If you do need to provide your birth certificate for some reason, call ahead and ask them If a copy will be sufficient. If you must present the original, take it with you just for that appointment.

Passport

Carry it with you only when traveling. When you return from your trip store it safely at home.

Don’t Write it Down

Don’t write down important numbers or other information, instead store what you need in the password manager on your phone.

Checkbook

Carry your checkbook only when necessary, instead of writing a check when shopping or paying bills consider using a cash back credit card. A cash back card is a more secure way to pay and you earn points each time you use it.

Credit & Debit Cards

Carry only the cards you will need and leave the rest at home. If your purse or wallet is lost or stolen you will need to cancel and replace only the cards you had with you.

Cash

Carry only what you need.

Receipts

Receipts can contain personal information, keep them at home.

Gift Cards

Carry these only if you will be using them that day. If a gift card is lost or stolen it is difficult to get the merchant to replace the card.

Library Card

There have been incidences when a thief has used a stolen library card to check out a bunch of books and then sell them for a profit.

Spare Keys

If your keys are stolen the thief has access to your home and car, changing locks can be time consuming and expensive. Instead keep a set of spare keys with a trusted relative.

COVID-19 Vaccination Card

These can contain your date of birth and other personal information, file them at home.

Medicare and Insurance Cards

Carry these only when needed for an appointment.

Use Your Digital Copy

All of the items I mentioned can be digitalized, this allows you to keep the originals at home but still show a copy when needed.

Preventing Theft

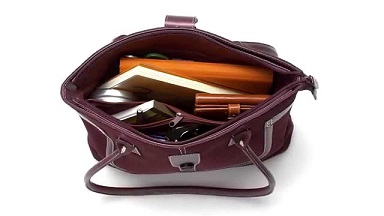

Never leave your purse or wallet unattended. In public settings always keep your purse or wallet with you. Keep the zipper closed on your purse at all times and don’t carry a bag that does not shut securely, draw string or flap closures do not offer enough protection. Don’t carry a backpack as a thief can easily steal from a backpack without you even being aware.

Don’t leave your purse or wallet in your car, even if it is locked.

Consider a purse with an over the shoulder strap, or one that you carry around your waist as opposed to a handbag or bag that just rests on your shoulder. Grab and go thieves are looking for something that is easy to snatch from you. Buy an anti-theft bag or wallet. Some offer protection against RFID (Radio-Frequency Identification) reading devices. Some have anti-slash fabric or wire webbing and a locking system for zippers and straps. Here are some examples of anti-theft bags and wallets from Amazon. Anti-Theft Bag’s & Wallets Anti Theft Wallet

Steps You Can Take to Stay Safe

Install a Home Safe

Install a fireproof safe to store your valuable items, look for one that can be bolted to the wall or floor.

Make Copies

Make a copy of all your important documents. Credit and debit cards, driver’s license, Social Security card, birth certificate and anything else of value. Copy the front and back of each item. In the event that one or more of those items is lost or stolen you will need the information contained in those documents to report the loss and apply for new documents. Keep the copies locked in your safe.

Make a List

Make a list of everything that you carry with you. If loss or theft does happen you will need to know exactly what you had in your purse or wallet so you know who to contact to report the loss.

Keep Your Wallet Secure

Keep your wallet in a front or inside pocket, preferably one with a zipper. Wallets carried in the back pocket are an easy target for thieves. An inside coat pocket with a zipper is an ideal location.

Watch Out for Snoops

Be on the guard for “shoulder surfers” these thieves look over your shoulder while you are entering PIN numbers, paying with a credit card and making other transactions. They can take a picture or video of your transactions and use it to steal information from you.

What To Do If Theft Occurs

Report the loss as quickly as possible. If you made a list of the contents of your purse or wallet, use the list to contact those you need to and report the loss.

Track Your Phone

If your smartphone was in your purse, you may be able to track it if you previously setup the find my phone feature.

Places To Contact

Who you contact depends on what items were lost or stolen. Here are some places you may need to get in touch with. If other items or information were lost or stolen contact those places as well.

Bank & Credit Card Company

Report your debit or ATM card lost or stolen immediately. Depending on the type of card you have a limited about of time to report the loss. Federal law says that once you report a lost or stolen ATM or debit card you cannot be held liable for unauthorized transactions that occur after that time. Your card will be cancelled and a new card will be issued. It is a good idea to also write a follow up letter or email to report the loss. Include the date and time you initially reported the loss, the date the loss happened, who you spoke to when you called, your name and contact information and the card number.

After the theft monitor your accounts online and check your statements for any unusual activity.

Contact your credit card company to report the loss. Call the phone number on the card, (This is why it is important to have a copy of all of your cards and other documents, so you know what phone numbers to call and what your account numbers are) The credit card company will cancel the card and issue you a new one. The Federal Trade Commission limits your losses. If someone made fraudulent purchases on the card before you reported it, your liability is $50.00. In addition, some credit card companies offer zero liability protection so you may not owe anything.

Medicare, Medicaid & Insurance Company

If you had any of these cards with you contact the agencies to report the loss and request new cards. Each place will tell you what other steps you should take.

Car & Homeowners Insurance

Contact your insurance company to request a new policy number and replacement card.

Passport

If your passport was in your bag or wallet call the U.S. State Department to report the loss and request a new passport.

Driver’s License

Call your local DMV and find out which documents you need to bring with you to get a replacement.

Social Security Card

Call your local Social Security office to report the loss and they will advise you on what needs to be done and issue you a new card.

File a Report with the Federal Trade Commission (FTC)

Visit the Federal Trade Commission’s website Federal Trade Commission Identity Theft and report the loss. They can help you with problems caused by identity theft.

File a Police Report

Many people do not file a police report because they don’t believe the police will be able to help them recover their stolen items. While that may be true, filing a police report is crucial because it can protect you in the event of identity theft. If you are the victim of fraud or identity theft at a later time the police report will help serve as evidence that you were the victim of theft.

Get the case number, the officers name and badge number and a copy of the police report for your records. Get a copy of the officer’s business card. It may take some time for them to complete the report. Call and follow up. Once the report is done get a copy.

Credit Bureaus

Call the three major credit bureaus. Experian, Equifax and Transunion to report the theft. If you have not already frozen your credit with each agency do so right away. Also request a fraud alert be placed on your accounts. Then monitor your accounts for any unusual activity.

Order a Credit Report

Visit Annual Credit Report to order your free report. You are entitled to one free report per year. Wait a few months after the theft as it may take some time for any fraudulent activity to show up on your report. When you receive the report check it carefully for anything unusual.

Update Automatic Payment Information

Update any automatic payment information that comes out of your bank account or credit card. Remove the old information and enter the new. Also change your password for each website. Updating the payment information will secure the account and prevent any late charges due to the cancelled card being denied.

Other Institutions

Call any other institutions that you carried a card for, military ID, student ID, work ID, loyalty cards, AAA, AARP, library cards and membership cards to report the loss and request a new card.

Seek Legal Advice

You may also want to contact a lawyer. Identity theft can create legal problems and a lawyer will be able to offer advice on what additional steps should be taken. Each state has different laws and agencies that help victims of identity theft and a lawyer can put you in contact with those agencies.